Leasing

& Equipment Finance

Leasing & Equipment Advisory Services

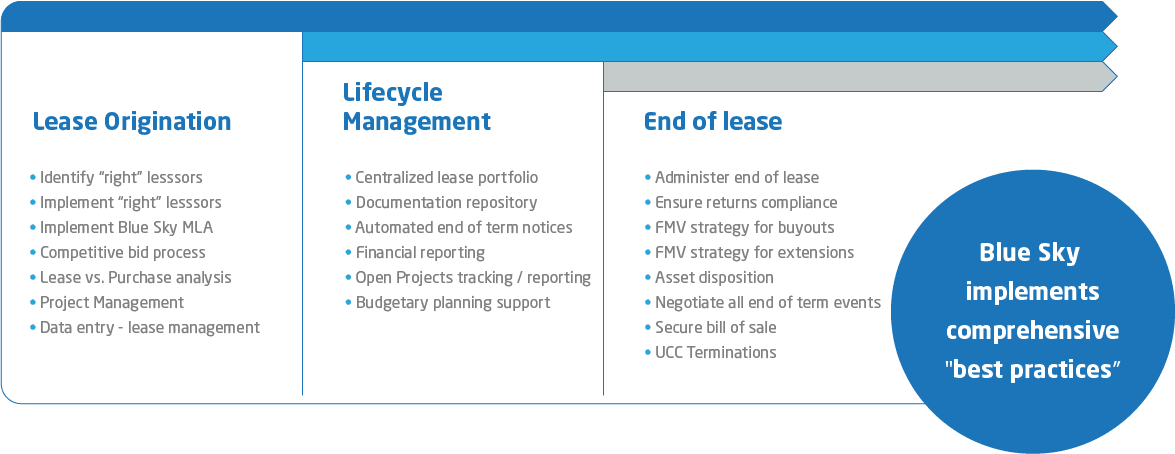

Put the power of Blue Sky’s proprietary tools and portfolio management to work for you. We take a comprehensive portfolio approach to developing and managing leasing as a strategic part of your capital structure. We use portfolio analytics and best practices to optimize every part of the leasing program from origination to termination to ensure that leasing is the cheapest and most flexible form of liquidity in the capital structure.

Our team has a wealth of experience implementing lease management strategies, policies, and systems for companies ranging from $100M to over $20B. We are experts at quickly identifying opportunities for immediate and long-term savings.

Blue Sky’s team of leasing professionals apply project management and real time market intelligence for immediate improvements and developing cost-effective solutions to improve the financial performance of your equipment lease contracts.

Blue Sky delivers immediate savings from leveraging direct contacts with the banks capital markets syndications groups as well as a vast network of proven, best in class, lowest total cost of contract bank, captive and independent funding sources for equipment leasing.

Blue Sky applies systems, expertise, and proven processes to quickly develop a comprehensive lease financing program for nearly any company regardless of their size, industry, geographic location, credit profile or asset class. Blue Sky clients benefit from our lease management and advisory services ranging from RFP development, transaction structuring, transaction negotiations, Lease Contracts negotiations to end of term F.M.V. negotiations.

Looking for the best equipment financing quote?

Blue Sky’s Lease Services

Tools & Services

Blue Sky Capital Strategies delivers immediate and long-term savings through our proprietary platform of Lease Management and Advisory services.

This unique Lease Management and Advisory platform delivers significant savings throughout the term of the lease by seamlessly integrating three best-in-class leasing disciplines to elevate companies to the top percentile in the major benchmarks such as:

- Leasing R.F.P. Library

- Lease Contract Documentation

- Documented Processes

- Portfolio & Life Cycle Management

- Financial Analysis, Disclosure, & Compliance

- Project Management

Portfolio Manager™

Portfolio Manager™ is Blue Sky's proprietary cloud-based SaaS (software as a service) solution for centralized lease contracts management and an essential tool for supporting your leasing portfolio.

Portfolio Manager™ provides a simple and efficient executive level dashboard with an intuitive user interface providing a streamlined approach for gaining immediate access to critical data and insight for budgeting, reporting & compliance, lease documentation, equipment tracking and unlimited reporting. Portfolio Manager™ has supported over $4 billion of lease contracts, hundreds of thousands of assets and thousands of equipment lease contracts both domestically and internationally.

Find out more about how Portfolio Manager™ can help with your equipment lease contracts.

Blue Sky Investment Banker Approach

- When the CFO or Treasurer modifies the capital structure for the company, they typically engage an investment banker or a financial advisor for anything ranging from an ABL facility, a revolver, public or private debt, or bonds.

- We like to refer to leasing as the medium-term capital part of the capital structure and our clients typically refer to Blue Sky as the investment banker for their lease portfolio.

- Leasing is the ONLY part of the capital structure that has ever been delegated to the business units, sourcing / procurement – and the lessors are profiting.

- Blue Sky structures equipment lease contracts to meet balance sheet metrics, management business objectives and budgetary constraints.

- Blue Sky applies proven portfolio management processes, sophisticated systems and software to proactively manage the lease portfolio as a strategic compliment to the company’s capital structure.

Immediate and long term savings

Before Blue Sky

- Utilize the Lessors Lease Contracts

- Limited RFP bids / existing lessors

- Transactional Pricing

- Unknown exit / termination strategy

- Multiple systems and worksheets

- No central data repository

- Lack of documented processes

- Incomplete leasing strategy

- Excessive month to month e.o.t.

After Blue Sky

- Blue Sky common form of MLA

- Extensive network / comprehensive RFP

- G.P.O pricing, realtime market intelligence

- Pre-negotiated end of term options

- Professional grade project management

- Central / Global data repository with FX

- Documented processes / best practices

- Clearly defined portfolio lease strategy

- Micro managed end of the term negotiations

Get in touch

For immediate help, call us now at 989-310-3988